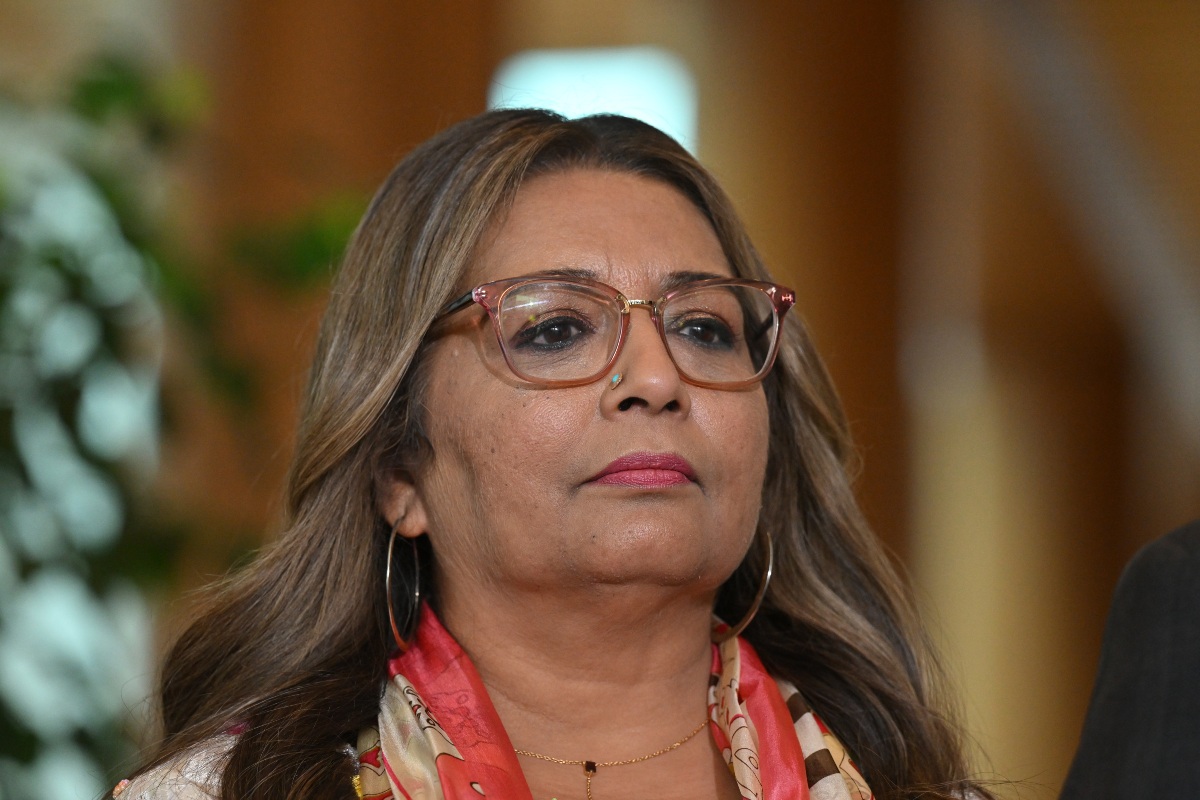

Image: Greens Senator Mehreen Faruqi. Photo: AAP Image/Mick Tsikas.

By LAUREN FROST

Millions of Australians could be hit with thousands of dollars of increased student debt after Labor and the coalition have knocked back a Greens bill to end indexation.

The bill, which was put forward by Senator Meereen Faruqi, Australian Greens Deputy Leader and Education spokesperson, would have put an end to the rapidly rising indexation on student debt as well as increase the repayment threshold.

Last year, Aussies with student debt were smashed by a record high indexation rate of 3.9%, increasing the average student loan by a whopping $923.

This year on June 1, the already record high indexation rate is set to nearly double, with student debt holders likely to be facing an indexation rate of about 7%.

This will mean people with the average $24,770.75 worth of student debt will be hit with a $1700 increase. Those with student debt of $40,000 or higher will face a rise of $2876.21.

“The growing burden of student debt is making news every day and it’s beyond clear that urgent intervention is warranted. But Labor has elected to sit back and watch as millions of Australians are hit with a student debt avalanche on June 1,” Senator Faruqi said.

How does the growing student debt crisis impact you?

I have just launched an online student debt calculator so you can estimate how much your HECS/HELP debt will rise come June 1.

Use the calculator now 👇🏽https://t.co/mfc2oUpGdd#FreezeStudentDebt #StudentDebtAvalanche pic.twitter.com/8In1NTQmGG

— Mehreen Faruqi (@MehreenFaruqi) April 18, 2023

The indexation rate is tied to inflation, hence the soaring impact on student debt. With wages falling, the situation is becoming even more crippling for those with student debt.

Last year, wages fell by 4.2%, the biggest drop since the ABS began tracking wages in 1997.

“An education system that traps graduates in a debt spiral and forces them to repay student loans when they are barely earning above the minimum wage is unsustainable and broken,” Senator Faruqi said.

“Soaring student debt is locking people out of the housing market, inflaming the cost of living crisis, crushing dreams of further study, stopping people from starting families and causing enormous mental and financial stress,” she said.

Public hearing on indexation bill

The Education and Employment Legislation Committee held a public hearing in March this year to discuss the bill.

“The way you get HECS is that you tick a box and, all of a sudden, you have it, really. It’s not that complicated,” said President of the National Union of Students, Bailey Riley who was a witness at the hearing.

In reference to the cost, the indexation and the repayment kick-off level of HECS loans, Riley noted that, “People don’t completely understand that when they go into the degree, because it’s not really spoken to them.”

Another witness in the hearing, Jessica Tran, spoke about the impact her student debt is having on her day-to-day life.

“Freezing indexation for my HECS debt would mean giving me a break from the mental stress of knowing my HECS debt is going to go up so massively this year,” she said.

“The idea of being in debt and having a student loan for ever is really, really scary. It doesn’t feel sustainable and is really unfair. A loan is something that should be reasonable to pay off over time.”

Tran said that if it weren’t for her HECS debt repayments this year, “it would mean a lot less stress on me and I’d feel less overwhelmed. It would give me more spending power and autonomy over my hard-earned wage, and I could put it towards something more meaningful to me and my family.”

“We deserve to not just live but to have extra money to go towards us thriving. Why did older generations get to study at uni for free when we are facing HECS debts that are going up almost faster than we can pay them off?”

Despite the evidence provided by the witnesses in the public hearing in March, the committee chose not to support the Faruqi’s bill on April 17.

“While the committee agrees that measures should be taken to ease the cost-of living burden on Australians, it is unclear whether the measures proposed in the bill will achieve this effectively,” Senator Tony Sheldon, chair of the committee stated.

“The committee accepts the evidence of some inquiry participants that the removal of indexation from student loans will not ease the cost-of-living for individuals with a loan in the short-term, given that an individual’s repayments are calculated based on the individual’s income, rather than the total amount of the loan.”

“In addition, the committee notes that an increase in the minimum repayment threshold may significantly increase the proportion of debt that is not expected to be repaid, in turn impacting the long-term financial sustainability of the loan programs,” he said.

“The committee is particularly concerned about the uncosted financial implications of the bill which, according to the departments’ evidence, could be in the order of $2 billion, and $9 billion for ongoing revenue effects.”

USyd SRC weighs in